The Risk Paradox: Why Playing It Safe Is the Riskiest Strategy of All

- Anne Werkmeister

- Aug 25, 2025

- 7 min read

I've been thinking lately about why some people seem to have all the luck when it comes to business success. You know the type, they launch venture after venture, some fail spectacularly, others succeed beyond imagination, and somehow they always land on their feet. Meanwhile, others work just as hard, are just as smart, but never seem to catch the same breaks.

The difference isn't luck. It's risk capacity.

Consider this: a wealthy entrepreneur can afford to lose $100,000 on a failed venture, it stings, but it doesn't threaten their housing, healthcare, or children's education. For someone living paycheck to paycheck, risking even $10,000 could be catastrophic. The mathematical reality is stark: the rich aren't necessarily more audacious, they simply have a fundamentally different relationship with risk. Their safety net transforms potential catastrophe into acceptable experimentation.

This observation reveals a profound truth about how risk-taking shapes not just individual success, but entire organizations and economies. Yet paradoxically, as I've observed the modern business landscape, I see a troubling trend: the very institutions that were built through bold risk-taking are now systematically eliminating their capacity to take the risks that could secure their future.

The CEO Dependency Trap

Recent research into biotechnology firms reveals a fascinating contradiction at the heart of modern leadership. Visionary founders, those willing to risk everything on breakthrough ideas, create companies that become entirely dependent on their personal risk-taking capacity. These leaders don't just make risky decisions; they become the sole arbiters of what risks are acceptable for their organizations to take.

The data is sobering. Companies highly dependent on founder-CEOs experience an average 32% decline in value within two years of a leadership transition.

Why? Because when the risk-taker leaves, the organization suddenly discovers it has no institutional capacity for intelligent risk assessment or bold decision-making.

It's like watching a master chef leave a restaurant, only to discover that no one else in the kitchen knows how to cook without following exact recipes. The creative spark, the ability to improvise and adapt, the willingness to try something that might not work, all of that walks out the door with the visionary leader.

This creates what I call the "founder's risk monopoly." One person holds all the risk-taking capacity, makes all the bold decisions, and becomes the bottleneck for organizational courage. When they're gone, the company doesn't just lose a leader, it loses its ability to take the risks necessary for continued innovation and growth.

The Corporate Risk Aversion Machine

But here's where things get really interesting, and deeply problematic. Most established companies have built elaborate systems designed to eliminate risk entirely. They've created decision-making frameworks, approval processes, and governance structures that prioritize predictability above all else.

Walk into any large corporation and you'll find teams of people whose primary job is saying "no" to anything that hasn't been proven elsewhere. Risk management departments, compliance officers, legal teams, and multiple layers of approval, all designed to ensure that nothing uncertain ever happens.

On the surface, this seems responsible.

Who wants to be the person who approved the decision that lost millions? But this systemic risk avoidance creates a deeper, more insidious problem: it transfers all risk from intelligent, calculated experimentation to the ultimate risk – irrelevance.

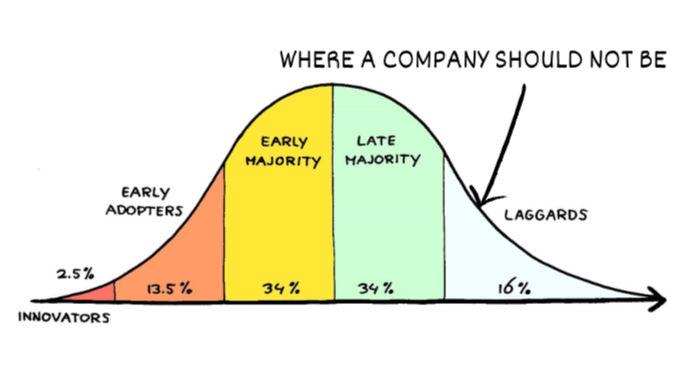

Consider the irony: companies spend enormous resources avoiding small risks while sleepwalking toward the massive risk of being disrupted by competitors who are willing to experiment, fail fast, and learn quickly. They optimize for quarterly predictability while jeopardizing their long-term survival.

The Innovation Paradox

This risk aversion becomes particularly dangerous in our rapidly changing economy. The companies that survive and thrive are those that can spot emerging opportunities, test new approaches, and pivot when conditions change. But you can't do any of that without accepting uncertainty and the possibility of failure.

I've watched countless organizations analyze potential innovations to death, forming committee after committee to study what their more agile competitors are already implementing. By the time they've reduced the risk to an "acceptable" level, the opportunity has either vanished or been captured by someone willing to act with incomplete information.

The cruel irony is that their systematic approach to avoiding risk makes them incredibly vulnerable to disruption. While they're perfecting their risk management frameworks, startups with nothing to lose are experimenting with the business models that will define the next decade.

The False Safety of Systems

Perhaps most problematic is the illusion of safety that these risk-avoidance systems create. Leaders convince themselves that following established frameworks eliminates risk, when in reality it just makes risks invisible, until they become catastrophic.

Think about it: every major business disruption of the past two decades caught established players off guard, despite their sophisticated risk management systems. Kodak had excellent risk controls, yet failed to anticipate how digital photography would destroy its film business. BlackBerry had strong product planning and security credentials, but couldn’t imagine that consumers would prefer touchscreens and app ecosystems over physical keyboards and enterprise-grade email.

These weren’t failures of risk management.

They were failures of risk imagination.

The companies were so focused on managing known risks, cost overruns, compliance, timelines, that they became blind to the unknown risks that ultimately destroyed them.

The Strategy Trap: When Planning Becomes Copy-Pasting

Here's another uncomfortable truth: any strategy that contains no element of risk is simply a copy-paste of what someone else has already done. If every component of your strategic plan can be measured, predicted, and guaranteed, you're not innovating, you're following a playbook that's already been written.

Think about it logically. True innovation, by definition, involves doing something that hasn't been done before. And anything that hasn't been done before carries inherent uncertainty and risk. When companies insist on strategies where every outcome is predictable and every metric is benchmarked against existing performance, they're essentially guaranteeing that they'll never create anything genuinely new.

I've seen countless strategic planning sessions where teams spend months crafting elaborate plans based entirely on proven best practices and industry benchmarks. They feel productive because they can point to data that "proves" their approach will work. But here's the problem: if the data already exists to prove it works, then someone else has already done it. You're not creating competitive advantage, you're catching up to where the market was two years ago.

How can you possibly innovate when your strategic framework explicitly eliminates anything that hasn't been tested and measured elsewhere? It's like trying to explore new territory using only maps of places that have already been thoroughly explored. You'll never discover anything new because you've designed a system that only takes you to known destinations.

Reclaiming Risk as Competitive Advantage

So what's the alternative? How do we build organizations that can take intelligent risks, without becoming recklessly dependent on a single visionary or paralyzed by bureaucracy?

The answer lies in institutionalizing risk capacity across all levels of the organization. Rather than centralizing bold decision-making in a founder or eliminating uncertainty through excessive controls, high-performing organizations embed calculated risk-taking into their structures, teams, and processes.

This means:

Developing people who can assess opportunities with incomplete data, make decisions that might not work, and learn quickly from outcomes, whether positive or not.

Designing processes that reward experimentation, not just success. Risk becomes a learning vector, not a blame vector.

Creating formal structures—project teams, innovation squads, and business units—that are specifically mandated to explore uncertainty, test new ideas, and challenge the status quo.

Allocating budget explicitly for risk: quarterly or annual funding set aside for experimentation, prototypes, moonshots, or pilot programs. When a company puts real money behind “trying new things,” it signals that risk is not just tolerated, it’s strategically essential.

Building a culture where intelligent failure is seen as progress. Mistakes made in the service of learning should be debriefed, not punished. Teams should feel psychologically safe to propose bold ideas and act without fear of retribution.

Ultimately, in a world of constant volatility, the ability to take informed risks isn’t a luxury, it’s a survival trait. The organizations that thrive tomorrow are the ones structurally, financially, and culturally prepared to explore the unknown today.

The Risk Imperative

We stand at a critical juncture. The organizations and leaders that will define the next decade are those who can navigate the space between reckless gambling and paralyzing caution. They understand that avoiding all risk is itself the ultimate risk, and they've developed the institutional courage to act decisively in uncertain conditions.

The question isn't whether to take risks, in our rapidly evolving world, standing still is the riskiest position of all. The question is whether we have the wisdom to take risks intelligently, the systems to support experimentation, and the courage to act when the path forward isn't completely clear.

Because ultimately, fortune doesn't favor the bold just because they're lucky. It favors those who have developed the capacity to see opportunity in uncertainty and the courage to act on it. In a world where change is the only constant, that capacity isn't just valuable, it's essential for survival.

The organizations that understand this will thrive. Those that don't will join the long list of companies that played it safe all the way to irrelevance.

Resources

Further Reading:

Devy, A. Z., Husen, A., Purwandari, D. A., Ginting, N. R. B., & Ardiyanti. (2025). The Paradox of Visionary Leadership: Sustainability Risks in Founder-Led Biotechnology Firms. Syntax Admiration, 6(7), 1531-1537.

Thornton, A. M. A. (2025). Leading in Complexity: An Initial Enquiry in Tasmania. Tasmanian Leaders Inc.

Additional Studies on Risk and Leadership:

Bennedsen, M., Perez-Gonzalez, F., & Wolfenzon, D. (2020). Do CEOs matter? Evidence from hospitalization events. Journal of Finance, 75(4), 1877-1911.

Khan, S., Li, J., & Park, M. (2023). The visionary dependency: How over-reliance on charismatic founders stifles organizational resilience. Journal of Management Studies, 60(5), 1128-1158.

Peterson, R. S., Smith, K. G., & Owens, T. J. (2022). The failure premium: Why autocratic leadership increases organizational risk in 85 case studies. Journal of Organizational Behavior, 43(5), 712-730.

Wasserman, N. (2017). The founder's dilemmas: Anticipating and avoiding the pitfalls that can sink a startup. Princeton University Press.

Comments